What does the new Massachusetts Paid Family and Medical Leave mean for your employees and your business?

Welcome to another Insource HR update, where we aim to keep you up to date with the latest HR developments and help you understand what they mean for your business.

This time, we’re talking about the Paid Family and Medical Leave program (PFML) that was signed into Massachusetts law in 2018.

Note: The most up to date version of this article is here.

There’s a lot to understand in this particular piece of legislation, so we’re breaking it down to highlight only the most important info for you and your employees.

What this means for your employees

Beginning in January 2021, Massachusetts employees — and in some special cases non-employees and former employees — will be entitled to the following each year:

- Paid medical leave of up to 20 weeks for an individual’s health conditions

- Paid family leave of up to 12 weeks

- Combined paid medical and family leave of up to 26 weeks.

While on leave, Massachusetts employees will continue to receive a percentage of their average weekly wages – the exact portion depends on how much they earn relative to the state average.

The PFML program will be funded by premiums paid by employees, employers, and the self-employed and administered by the state.

What this means for your business

For businesses, PFML incurs extra costs and also creates some additional work: the draft regulations will require employers to file quarterly earnings reports and to remit contributions owed through the Department of Revenue’s MassTaxConnect system.

The Department of Family and Medical Leave will begin collecting contributions on July 1, 2019, and employers will be required to comply with the PFML’s posting and notice obligations from this date on.

Contributions will work as follows:

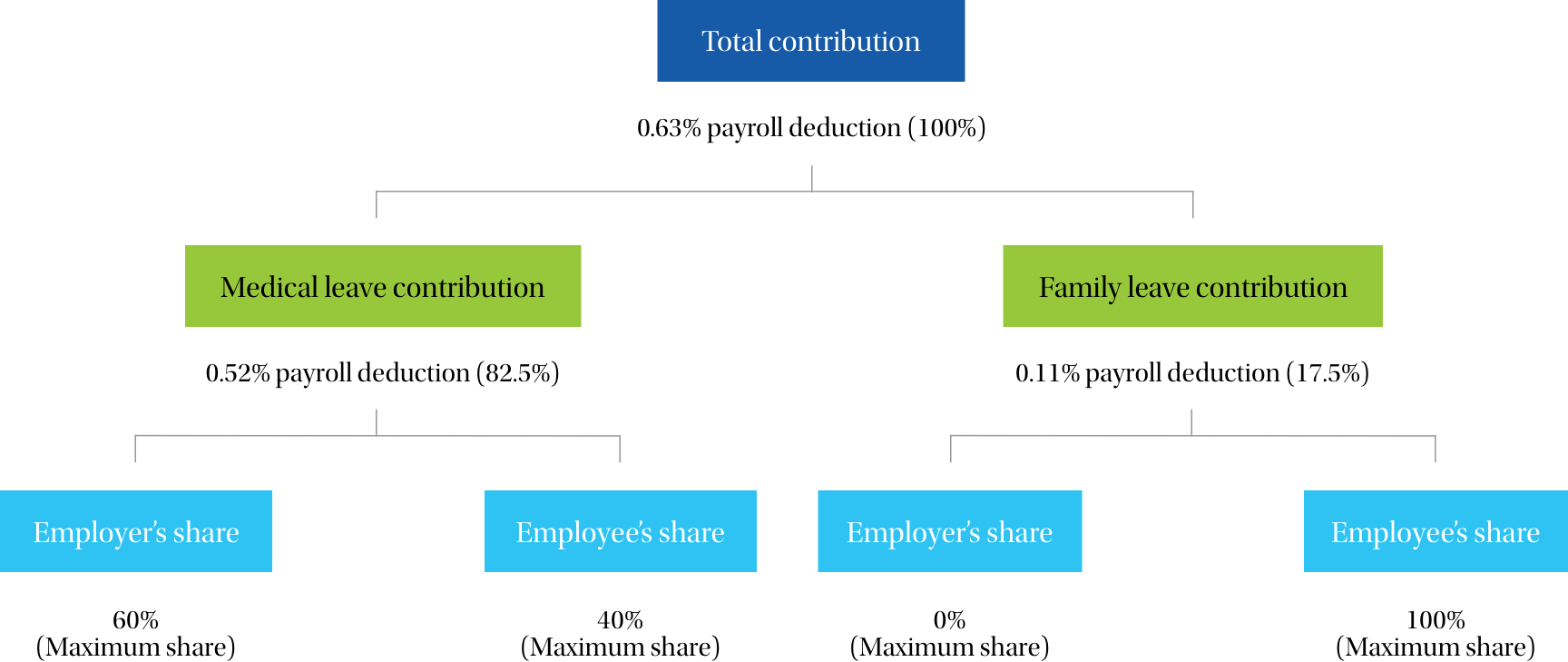

They are funded in part by a 0.63% increase in state payroll tax, which pays directly into the trust fund. This amount represents, on average, $4.00–$4.50 per week per employee. For employers with 25 or more employees, the contribution is shared, with the employer responsible for at least 60% of the medical portion only. This currently amounts to 82.5% of the total contribution. Employers will not pay any part of the family leave portion.

Employers with fewer than 25 employees may deduct all or a percentage of the contribution from employee wages (this will be further clarified in forthcoming regulations).

The Boston Business Journal summarized this information in a handy chart.

Who’s Paying What For Paid Leave?

For every $1,000 in pay, the state’s owed $6.30 for paid leave from businesses with 25 or more employees in Massachusetts. Here is the proposed breakdown.

Employers with 25 or more employees will be required to remit a contribution to the DFML of 0.63 percent of eligible payroll. This contribution can be split between employee payroll deductions and an employer contribution and will support both types of leave.

Credit: Boston Business Journal

How can your business prepare?

Be on the lookout for additional guidance on these changes expected to be issued at the end of this month (March 2019).

The full PFML legislation can be read at this link.

For more details on the PFML or the Pregnant Workers Fairness Act (April 2018), Equal Pay Act (July 2018), non-compete reform (October 2018), or the new limitations on permissible criminal history background checks (October 2018), please contact your Insource consultant or call our VP Saleha Walsh on 781-374-5103.

Related Insights

Zoom vs. Teams: What to Consider When Making a Swi...

Apr 3rd 2025Read More

Upcoming Massachusetts Pay Transparency Rules: Wha...

Mar 19th 2025Read More

Getting to Know You: Corporate Accounting Manager,...

Mar 11th 2025Read More