The Federal Corporate Transparency Act Requirements for 2024

We’d like to share some important news regarding regulatory changes affecting our for profit clients.

What is the Federal Corporate Transparency Act?

Starting in January 2024, the Treasury’s Financial Crimes Enforcement Network implemented the Federal Corporate Transparency Act, which requires businesses with fewer than 20 employees to provide ownership information. This change aims to strengthen efforts against money laundering and other illicit financial activities.

Who does this affect?

If your business was up and running before 2024, you have until the end of this year to submit the required information. If you are a new establishment formed during 2024, there is a 90-day window following formation in which to submit the required information. Tax-exempt 501(c), Political 527 (e) organizations, and Trusts do not need to comply with this requirement.

The good news is that this isn’t going to be a recurring headache, so unless there are changes in your ownership structure in the future, this is a one-time filing.

What do you need to do?

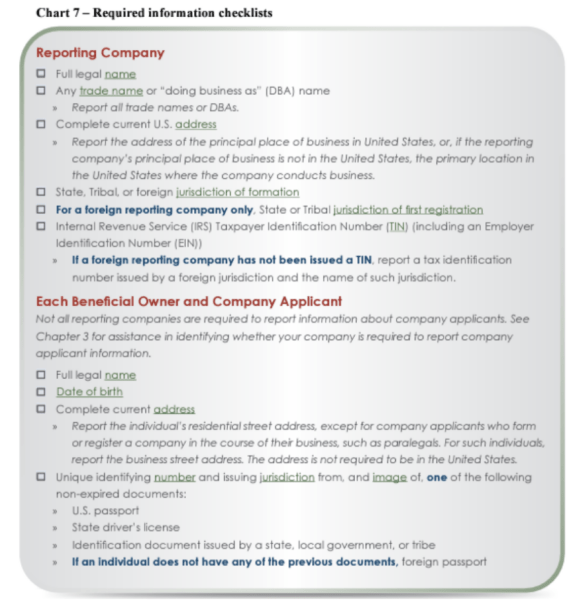

If your business needs to comply, you’ll need to fill out this form. Please refer to the below checklist to ensure you’ve covered all the bases. If your business was around before January 2024, you can skip the company applicant section.

For a deeper dive into what this means for your business, take some time to look through some of the Q&As.

For questions or for assistance in filing, please feel free to reach out to us at insource@insourceservices.com or 781-235-1490.

Related Insights

Upcoming Massachusetts Pay Transparency Rules: Wha...

Mar 19th 2025Read More

Getting to Know You: Corporate Accounting Manager,...

Mar 11th 2025Read More

Getting to Know You: Engineering Director, Andrey ...

Feb 24th 2025Read More